Gamification is a proven marketing tool that companies love because it makes customer interactions fun and engaging. Who can resist a challenge?

By adding game-like elements such as points, badges, and leaderboards, businesses have found they can motivate customers to participate more actively.

This not only boosts customer loyalty but also increases brand awareness and sales. Successful examples like McDonald’s Monopoly game and Nike+ Run Club show how effective gamification can be in creating memorable experiences and building strong customer relationships.

Companies enjoy using gamification because it keeps customers coming back and helps them stand out in a competitive market, it's become the single most effective way of making customers sign up, keep coming back and buying even if they don't necessarily realise they are literally just a "pawn in the game"

I have worked in digital marketing for more years than I care to think, and have utilised gamification many times, but I like to think I have scruples and at least some moralistic thinking. I wholeheartedly believe that there are certain industries that should stay away from these practices, one of these industries being the financial sector.

Financial services are essential for the functioning of our economy. They provide us with the means to save money, invest in the future, and protect ourselves against financial risks. However, there is a growing trend towards the gamification of financial services. This is a dangerous trend that could have serious consequences for consumers.

Like many people I try my hardest to keep on top of my financial situation, part of that is utilising a fantastic service form Inuit called Creditkarma which above other things, allows me to see my current credit report including any new searches or changes that may arise.

I realise this is a free service so they have to make money somehow, and they do this by offering me services which relate to my circumstances and credit record such as loans and credit cards, which I have always ignored.

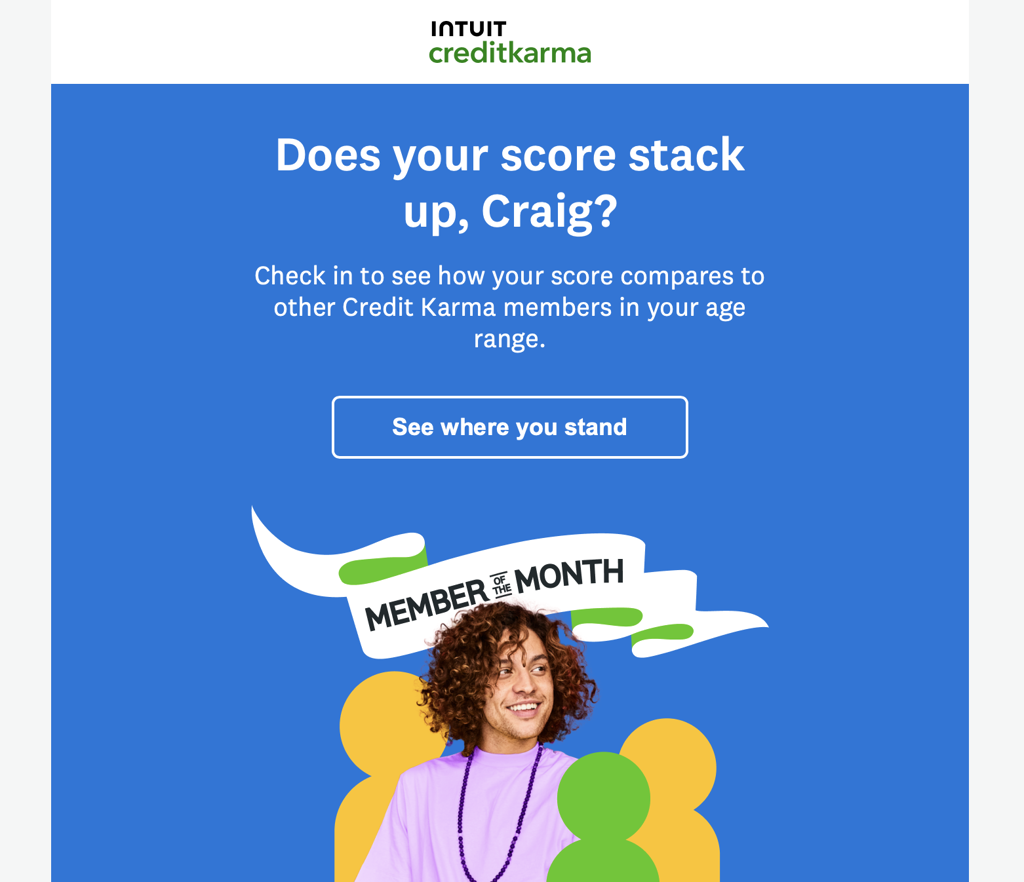

For the last few years, I would get an email once a month with an alert of an updated report and that was generally it, but over the past few week they have ramped up their email marketing to overdrive, I assume they have taken on a new digital marketing team or new marketing manager, but I am not impressed with their tactics... And was especially disappointed when this email appeared in my inbox.

They are literally pitching me against other members suggesting that I should try hard to get a better Credit Report than other people on the platform... How can this help me? A credit rating is a personal thing and varies massively on where you live, the credit you currently have, the credit you historically had and your attitude to repaying credit. It's not something that should be on a leaderboard!

Please, please, please keep gamification away from financial services, people quickly and easily get into financial trouble without trying to game a system to be better than someone else! And financial companies shouldn't be goading this!

- It can lead to risky behaviour. When financial services are gamified, it can make it seem like investing and other financial decisions are just games (of course). This can lead people to take on more risk than they should, which could result in financial problems.

- It can be addictive. Gamification can be very addictive, which can lead people to spend more money than they intended. This can be a serious problem, especially for people who are already struggling with debt.

- It can be unfair. Gamification can create a sense of inequality, as those who are good at games will be able to earn more rewards than those who are not. This can be unfair, especially for people who are new to investing or who do not have a lot of financial knowledge.

It's a dangerous trend that could have serious consequences for consumers. It is important to be aware of the risks involved and this is one area that people need to be able to make calculated, informed decisions. It feels crazy for financial companies to be using these tactics, they do have a moral duty of financial care after all!

Hey, I really could do with your help! If you find this article interesting, could you please do me a favour by either sharing it on your site or on social media. I would love to hear yours and other peoples' thoughts on this subject. And if this or any other content on the site has helped you and you would like to show your appreciation, then you can always

buy me a coffee ☕️ It would make the time I put into this more than worthwhile! Thank you 😃